Feb. 1, 2014 – Sarah Kalin

Many development projects rely on the public sector or philanthropic foundations in order to fund and sustain initiatives. What if instead, development projects could also harness the interest of private investors by promising a financial return on their investment along with positive juju? While many of us have eagerly been following the news stories of investors financing social projects using Social Impact Bonds or SIBs (most recently, $27 million was invested in a project dedicated to preventing recidivism in Massachusetts), organizations such as the Center for Global Development (CGD) and Social Finance have established a Working Group to try and figure out how to extend the model so that it can be applied to development projects. The result is what the Working Group refers to as a Development Impact Bond or DIB. A few months ago the Working Group released a full report (Investing in Social Outcomes: Development Impact Bonds), which details the Working Group’s recommendations. The report explains in detail how DIBs could be structured and implemented, as well as shares some interesting illustrative case studies (none of which have yet been implemented).

The way a typical DIB would work is comparable to a SIB. A donor or investor, such as USAID, would enter into a contract with a service provider agreeing to pay only for successful outcomes derived from specific development projects. The investor assumes the financial risk for the projects, but also has the opportunity to recoup its investment if predetermined outcomes are achieved. After the investment is made, the service provider implements the project (e.g. administering medication to a population at risk of HIV as a preventative measure), which is then closely monitored and evaluated by independent third party agencies. Only if there is evidence that the programs have successfully met the desired outcome (e.g. rate at which HIV has spread has decreased), will a so-called Outcome Funder, typically the government or public agency, then pay the initial investors their principal with a return, which is proportional to the level of success achieved. The Outcome Funders would be willing to pay due to the financial savings they now experience as a result of the project’s success (e.g. lower medical costs for the state, fewer orphaned children, more productive workforce). Most DIBs would require a lifetime of about 3-10 years in order to allow for both project implementation and outcome evaluation.

This model has the potential to make innovative projects addressing some of the world’s most challenging development problems into financial investment opportunities.

So what types of projects could such a model conceivably fund? The Working Group provides several examples, which range from education or public health initiatives to initiatives that promote energy efficiency or encourage entrepreneurship. Conceivably, any project that has a measurable outcome that leads to quantifiable savings for an Outcome Funder, which can be directly attributed to a specific intervention, could be financed using such a model.

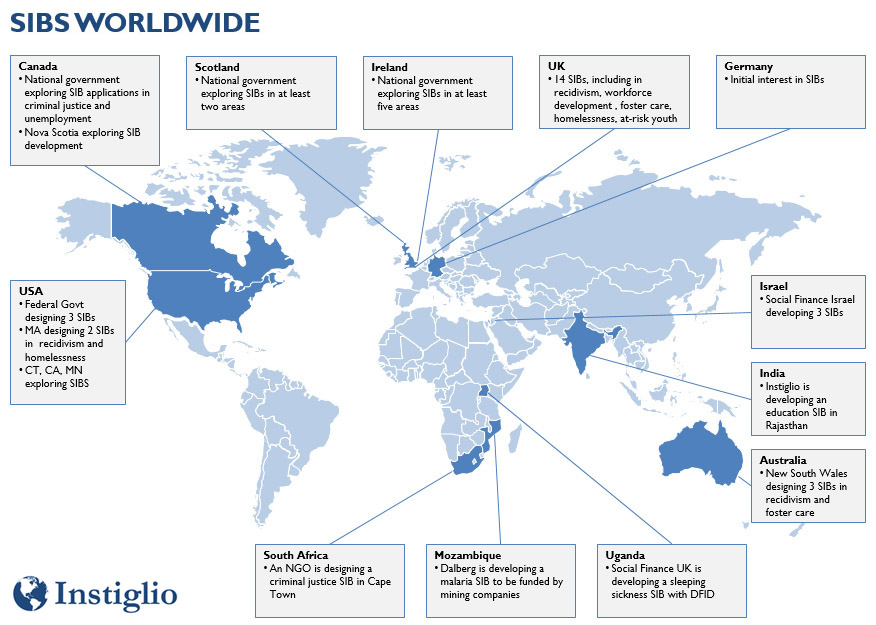

Thus far, SIBs have been launched in a number of countries, but no DIBs have yet been issued. Some challenges may be that quantifying cost-savings directly derived from a specific intervention is challenging and few projects have the historical data required to make a compelling case for investment. Additionally, political instability is an added risk that exists in DIB projects that may be less present in SIB projects. This is because DIBs often require long-term partnerships and investors must be confident that Outcome Funders will remain committed to paying them if the outcome benchmarks are achieved regardless of regime changes or changes in political priorities.

While this model is currently untested, its promise to create investment opportunities with potential returns where previously there were only opportunities for one-time donations is exciting and worth following.

Picture source: Instiglio