Jan. 27, 2014 – Julian Hill

China’s bout with the ever-so-dangerous pollutant, PM 2.5, has reared its ugly head more than usual as of late, showing us the possible costs of “progress.”

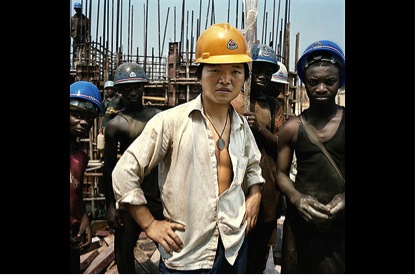

I donned a mask right as I passed police officers guarding the entrance to Beijing’s subway system. “Only in China can a black man wear a mask without purse-clutching or visual displays of anxiety,” I though to myself. However, just look at the photo from one of my days in Beijing, and you’ll see just how needed that anti-PM 2.5 mask was. Though at that time I knew I’d only need it for another month, I couldn’t help but wonder if substantial pollution, which has been an issue for other countries like the United States as they develop, has to be the cost of development.

Smog in China, which some believe annually causes the death of 350,000 folks, is linked largely with the country’s rising development over the past several decades. Since “opening up” its markets in 1978 under President Deng Xiaoping, China’s GDP averaged 10 % growth, allegedly lifting 500 million people from poverty. To accommodate this growth, the country has had to drastically increase its energy consumption (about half of the world’s coal supply) while measures for energy efficiency eroded.

China has not sat completely sat on its hands on this issue. In fact, China is the leading investor in green energy. Also, in 2009, the government did invest in tree planting.

However, the growth in smog may be explained by a number of factors. The devouring of non-renewable in spaces where there are neither enough trees to breakdown the byproducts of coal-burning nor enough wind to blow it away exacerbates a problem that is often epic around this time of the year.

Just how epic is the problem? The pollution has caused a debate around whether or not to use fireworks to celebrate the upcoming Spring Festival. During the festival in 2012, the levels of PM 2.5 at one point was 64 times what the EU recommends for an annual average—1,593. The government has even resorted to using huge monitors throughout the city to broadcast the sunrise.

Though a delicate topic, we should all be concerned. Of course, the U.S. government will act out of self-interest. I mean…hey…that’s what countries do, right? Perhaps knowing that folks in Los Angeles receive the gift of China’s smog quite often will help us think more seriously about how to move toward a future with safer, more efficient energy use. Otherwise, maybe you should save up for your masks now? I’ve got mine.