Dec. 6, 2013 – Julian M. Hill

China’s private sector increasingly active but not without backlash

At last Thursday’s Groundbreaking Ceremony, Kenya’s President Uhuru Kenyatta said that “it” would be a “landmark project both for Kenya and east Africa.” The “it” to which he referred is a 450-kilometre railway that will connect the Kenyan cities Mombasa and Nairobi—Kenyatta anticipates that it will link all of East Africa by extending as far west as Kigali, Rwanda.

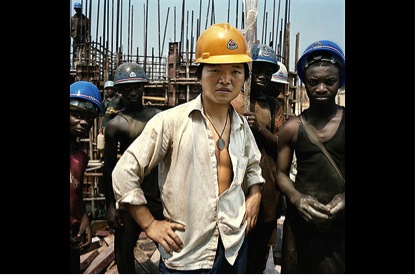

Chinese companies have funded this and other types of large-scale projects in Africa for years, developing the Continent’s energy infrastructure to the delight, or fright, of many. In East Africa, though, China’s private sector has become especially active in recent months.

At the end of October, six Chinese companies and the Tanzanian government signed seven contracts worth 1.7 billion USD to construct power plants and housing units. Just a month before, a Chinese energy company signed a deal with the Ugandan government to build a phosphate mine and power plant, while another firm, of the oil variety, also agreed to construct an oil field. September did not leave Burundi out of the loop—it invited Chinese companies to build a presidential palace and hydropower dam.

Not everyone is happy about these developments. For example, Ugandan civil society organizations have recently called out China to step up its contributions to the Global Fund, which works to eradicate AIDS, TB, and malaria. China, which pledged 5 million USD to the fund over the past year, has invested billions in infrastructure projects to Africa just this year. Complicating this story is the fact that Chinese companies are doing some positive things in the region—joining UNICEF to provide mobile computer stations and sponsoring a Ugandan sports team just in the past week.

If the question is one of priorities, it is clear that at the end of the day, China, like any country, has its own self-interests. Asking China to increase Global Fund donations is valuable, but what will be interesting to see is what strategies East Africa’s civil society will use to push its governments to ensure that the needs of everyday people are not forgotten. Does this mean pushing for transparency, accountability, sustainability, and real shared benefit (see new South Africa Resource Barometer), outright protest, or some other alternatives? Regardless of approach, I hope they and their allies in East African nations learn from the lessons of their brethren elsewhere in Africa, and the world.

Useful Links

http://mobile.nation.co.ke/News/Kenya-launches–13-8bn-China-built-railway-to-boost-trade-/-/1950946/2092168/-/format/xhtml/-/qjg82wz/-/index.html

http://sleepout.com/nomad/president-uhuru-kenyatta-officially-launches-standard-gauge-railway-project-in-mombasa/

http://www.howwemadeitinafrica.com/chinas-investment-in-africa-is-positive-says-investment-advisor/33013/

http://www.reuters.com/article/2013/10/24/tanzania-china-financing-idUSL5N0IE30U20131024

http://online.wsj.com/article/DN-CO-20130919-002993.html

http://www.bbc.co.uk/news/business-24279582

http://www.globaltimes.cn/content/814549.shtml#.UpysNo3t62o

http://allafrica.com/stories/201312020555.html

[photo courtesy of “The China Africa Project”]